Recent research highlights a clear willingness to pay more for Canadian products, reflecting the country’s deep sense of national loyalty and pride in supporting local producers. Across income levels and regions, Canadians continue to choose homegrown options even when faced with significant price differences, reinforcing that the buy Canadian mindset remains strong.

Read time: 3 mins

Key Takeaways

- A majority of Canadians would pay a 20% premium for groceries produced entirely in Canada.

- The preference for Canadian-made goods spans all income levels and regions.

- Even at a 40% price premium, most respondents still prefer Canadian products.

- The “buy Canadian” sentiment remains enduring and deeply ingrained among consumers.

Following on from months of trade negotiations and tariff threats, Canadians steadfastly have their elbows up, and our latest research shows that not only is buying Canadian a nice to have, they are, in large measure, willing to pay more for assurance that the products they are buying are Canadian.

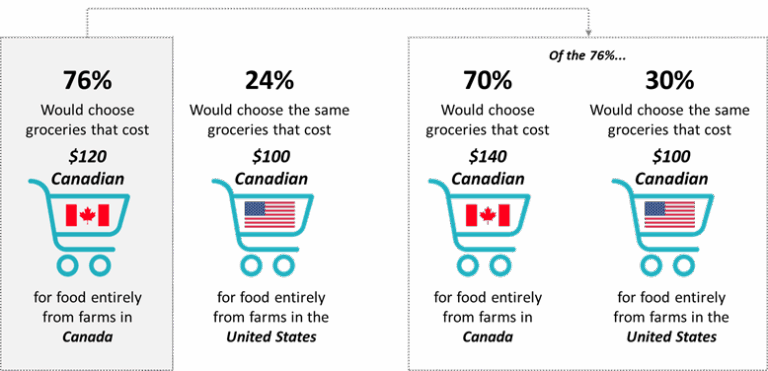

We asked, in a hypothetical pairwise choice, if residents would choose groceries that cost $120, with assurance that the food was entirely from farms in Canada, or if they would prefer to buy those same groceries for $100 knowing that the food was entirely from farms in the United States. Results show that resoundingly, Canadians say they would pick the more expensive basket. This finding is true regardless of region in Canada, and most importantly, regardless of income level.

Grocery Store Purchase Choices

To push the matter further, we asked the three quarters of the population who said they would be willing to pay that $20 premium for Canadian goods, if they would pay $140 for Canadian groceries, compared with $100 for products from the United States. Once again, a majority of that group said they would pay that increased premium for Canadian products. Again, results are consistent across income levels as well as other demographic sub-groups.

“It’s extraordinarily clear that Canadians are still very much seeking Canadian products to purchase, and now we have clear evidence that they feel so strongly, that a strong majority is willing to pay more for Canadian products,” said Margaret Chapman, COO & Partner. “Although many trends fade with time, the buy Canadian sentiment is clearly enduring.”

Results are from an online survey conducted in partnership between Narrative Research and the Logit Group. The survey was conducted between October 7 – 9, 2025 with 1,230 Canadians, 18 years of age or older from the Logit Group’s online Canadian Omnibus. Data were weighted based on the 2021 Census, by gender, age, and region to reflect actual population distribution.

FAQs

Many Canadians see buying domestic goods as a way to support local farmers, manufacturers, and the national economy, especially amid ongoing trade tensions.

No — the research found consistent willingness to pay more for Canadian products across all income brackets and demographic segments.

It signals an opportunity to emphasize Canadian origin and local sourcing in marketing and packaging to align with consumer values.

For more information, please contact:

Margaret Chapman, COO & Partner, Narrative Research – 902.493.3834, mchapman@narrativeresearch.ca or Sam Pisani, Managing Partner, Logit Group – 416.629.4116, sam.pisani@logitgroup.com.

Narrative Research is a non-partisan, 100% Canadian-owned research company, certified as a Women Business Enterprise (WBE). Narrative Research provides clients with state-of-the-art research and strategic consulting services.

The Logit Group is a leading North American data collection and market research execution company headquartered in Toronto, conducting large-scale projects for a variety of well-known research agencies and brands. Logit employs industry-best technologies.