A majority of Canadians are concerned about inflation and their ability to afford daily living expenses such as healthy food, heating and rent or mortgage.

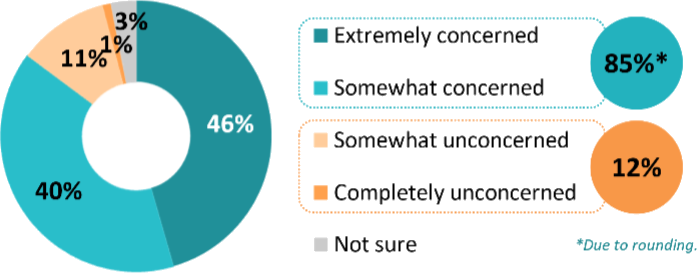

As the cost of living continues to increase around the country, daily necessities – such as healthy food, heating, shelter, and prescription medications – are contributing to high levels of concern. Our recent survey results show that a vast majority of Canadians are concerned about the impact inflation will have on their household finances over the next 12 months (85% concerned, with 46% being extremely concerned).

Concern about inflation is widespread among Canadian residents across all ages and other demographics.

Concern About Inflation When Thinking About Household Finances in the Coming 12 Months

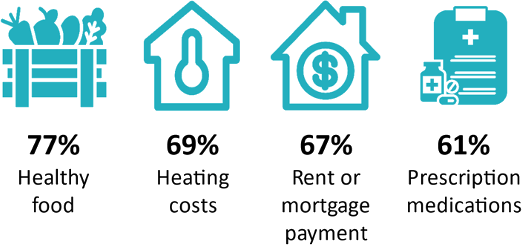

Current living costs are clearly having an impact on residents across the country, with between six-in-ten and three quarters being concerned with being able to afford various types of expenses. Being able to afford healthy food is a concern for three-quarters of Canadians. Heating costs are a concern for seven in ten, with rent or mortgage payments being a worry for a similar proportion. Of note, boomers are more likely to own their home without a mortgage, or have a fixed rate mortgage, and are less concerned with rent or mortgage payments (52%), whereas Millennials are most concerned with this type of expense (80%). Six in ten residents are concerned about affording prescription medications, and those with higher household incomes are less worried.

Extremely/Somewhat Concerned About Being Able to Afford

Across the country, concern for affording rent or a mortgage is most prevalent in BC, Ontario and the prairies, while residents in Atlantic Canada and the prairies have higher levels of concern about being able to afford heating costs. Residents of Quebec are less concerned in general with each of the forementioned living costs and have experienced slowed regional inflation so far in 2024 compared to last year (Consumer Price Index (CPI) (quebec.ca).

The questions asked were:

Thinking about your household finances for the coming 12-months, to what extent are you concerned about inflation?

To what extent are you concerned about being able to afford healthy food? Rent or mortgage payments? Heating costs? Prescription medications?

For more information, please contact:

Margaret Chapman, COO & Partner, Narrative Research – 902.493.3834, mchapman@narrativeresearch.ca or Sam Pisani, Managing Partner, Logit Group – 416.629.4116, sam.pisani@logitgroup.com.

Narrative Research is a non-partisan, 100% Canadian-owned research company, certified as a Women Business Enterprise (WBE). Narrative Research provides clients with state-of-the-art research and strategic consulting services.

The Logit Group is a leading North American data collection and market research execution company headquartered in Toronto, conducting large-scale projects for a variety of well-known research agencies and brands. Logit employs industry-best technologies.

Have a project that you’re looking to field?

Logit can help. Just fill out the form below and a Logit Group team member will be in contact with you shortly. Get a quote today.